France is a great country to invest in. Property prices are stable and sometimes offer great return on investment. If this is your first time investing in a property, the process can be time consuming as it requires proper planning. However, It can be an enjoyable experience if you are well prepared and informed on all possible requirements and procedures.

If you are looking to invest in France or thinking of buying a home for you family, this guide will facilitate the process for you.

1. Find a property:

Finding a property can be a difficult task. There are many website that can offer you a wide variety of property types depending on your preferences. Real Estate agencies can also offer you great help in finding the right property. There is also the option of public auctions which can offer you a great deal, but it requires some patience.

2. Price & Location Research:

It is important to do some research on the market prices and the best locations to buy in. Getting the best price is critical to many, therefore, some research is necessary to avoid paying more than the market price.

3- Make An Offer:

Once you find the property that matches the characteristics you desire, make an offer. A verbal or written offer are considered a contractual commitment. A formal written offer is called offre d’achat. Always make sure the sale is conditional and all the legal conditions are elaborated and agreed on. Keep in mind that the law allows you as a buyer seven days to withdraw from the contract without any penalties. No deposit is made at the time of the offer.

4-Contract & Deposit:

There two types of contracts: Promesse de Vente and Compromis de Vente.The promesse de vente is supervised by a notary, and the compromis de vente is a direct contract between the buyer and the seller without any third party involvement.

In both contracts, A deposit of up to 10% of the purchase price is made on signing of the agreement and the buyer has seven days during which time they can withdraw from the contract without penalty. Read the contracts carefully as they are binding legal contracts. The seller and the buyer have the right to add their own conditions, given that the other party accepts and signs.The notary public will also investigate if they are any financial liabilities on the property, or any outstanding legal fees. It is important to clarify any financial liabilities on the property before buying a it to avoid future obstacles.

5- Notary and Agency Fees:

Fees include notary fees are set by the French Minister of Justice at 5 percent up to €45,735 and 2.50 percent above that. You may also be liable for all or a share of the estate agents fees (up to 10 percent). Taxes and duties, notary fees, and usually the notary fees are paid by both the buyer and seller. the notary fee portion is approximately 1.33%.

There is an online Notary fees calculator that you can use for accuracy depending on the property price:

http://www.frenchpropertycentre.com/notaire-calculator/

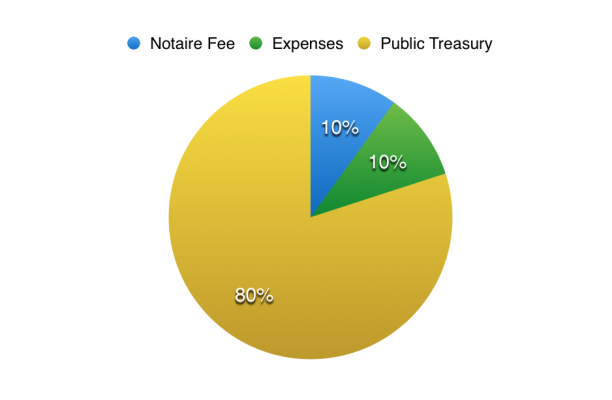

The graph above illustrates the fees percentage breakdown:

- Public Treasury fees include the state, local authorities (municipalities and other departments, Registration fees, taxes and VAT.

- Expenses includes town planning documents, mortgage registry (if applicable) and land registry.

- Notaire’s Fees is the notary fees applied to the sale and only consists of 10% of all fees.

6- Property Tax Fees:

There are two types of taxes applied on a residential property: land tax (taxe foncière) and local taxes (taxe d'habitation), which are due on 1 January every year, so you will pay a pro-rata amount if you buy a property few months after or before January 1st. .

• Older Property - The total fees and taxes payable for the purchase of an existing property are between 7% and 10% of the purchase price, excluding estate agency fees, although for very low priced transactions it may be higher.

• New Property - You will pay around 2% in fees and registration taxes, plus VAT at the rate of 20.0% on the purchase price (except for sales between private individuals), excluding estate agency fees.

7- Title Deed Contract

Once all the legalities and contracts are cleared, and the buyer is ready to pay the remaining amount the deed title contract known as Acte de vente is signed at the notary’s office and the sale has officially been finalized.

8- Insurance:

In France, all properties are required to be insured. When purchasing a property, it is important to find the right insurance coverage. You can either hire an insurance broker or insurance agent to handle the insurance coverage for you, or you can do some online research yourself before settling for your preferred policy. Make sure to read all liabilities, coverage and to provide correct information before signing the policy.